Download Presentation Slides: Hiring your 1st employee

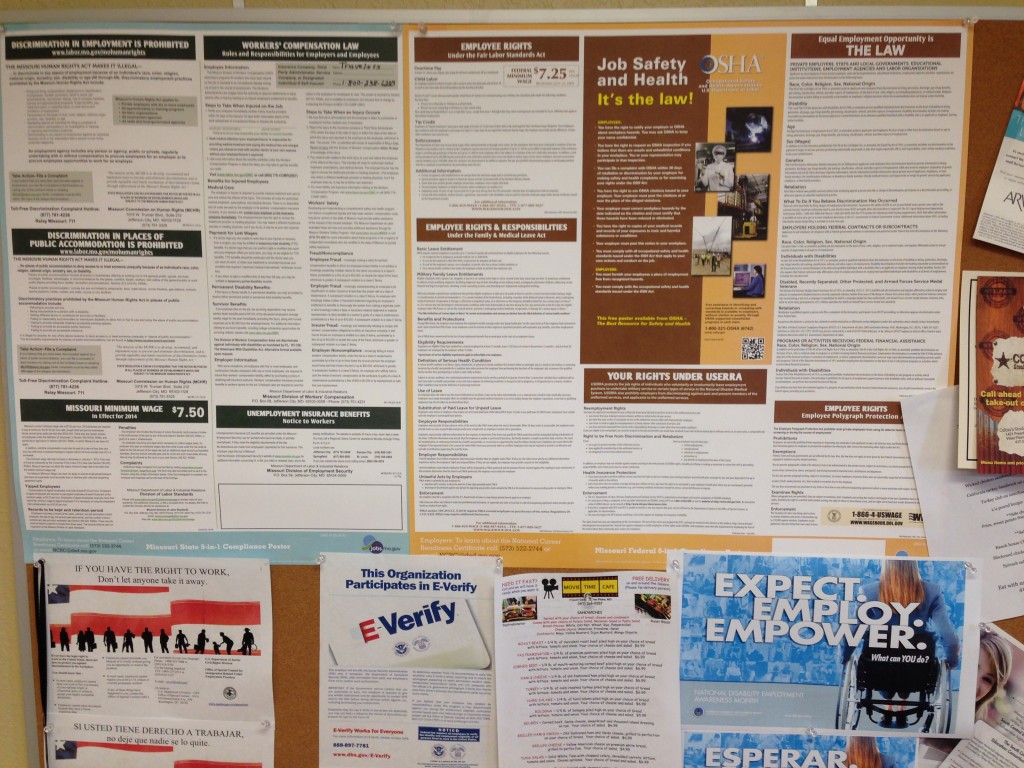

Photo: Required posters displayed at OzSBI in their break-room.

Training Handouts

[column col="1/2"]

Supplemental Materials

- Circular E

- Doing business in Missouri - Hiring Employees

- Employers Tax Guide

- How to Hire Your First Employees - Small Business - WSJ

- Independent Contractor Checklist

- IRS Guidelines Employee vs. Contractor

- Resource Guide for Employers

[/column]

[column col="1/2"]

Tax Forms

- f941

- Form 2699

- I-9

- Missouri 2643

- Multistate Employer Notification Form for New Hire W4 Reporting

- SS-4

- W-4 Federal

- W-4 Missouri

[/column]

The Missouri SBTDC Network subscribes to HRSimple.com. If you need any resources or assistance please don't hesitate to let you SBTDC business advisor know (there are a number of articles on HR issues and management in addition to the Missouri Human Resource Manual and the Model Policies and Forms for Missouri Employers).

Employers must collect taxes from their employees once they being to pay a salary or wages. The primary taxes include federal and state income taxes, Social Security (FICA) and Medicare taxes. Missouri requires employers to report each newly hired employee to the Department of Revenue within 20 calendar days of hire.

To start, obtain a copy of Employer’s Tax Guide (PDF) from irs.gov or call 800-829-3676. The “Circular E”guide explains federal tax withholding and Social Security tax requirements for employers as well as containing current withholding tables for you to use to determine how much federal income tax and Social Security tax is to be withheld from each employee’s paycheck.

Employees must complete the I-9 Employment Eligibility Verification and a W-4 form (PDF).

For more information, visit the MissouriBusiness.net article Doing Business in Missouri: Hiring Employees: http://missouribusiness.net/article/doing-business-in-missouri-hiring-employees

You can also contact the Missouri Career Center/Workforce Investment Board for additional information on your responsibilities as an employer and to learn about employee training programs that could save you money. For the West Plains office, contact:

Steven McCann

Business Services Representative

3417 Division Drive, Suite #1

West Plains, MO 65775

smccann@scwib.org

(417) 256-3158

(888) 728-JOBS (5627)

jobs.mo.gov/jobseeker/find-a-career-center

Additional Tax Resources

- 2015 Missouri Income Tax Reference Guide: http://dor.mo.gov/forms/4711_2015.pdf

- DOR Business Tax: http://dor.mo.gov/business

- DOR Sales Tax: http://dor.mo.gov/business/sales

- DOR Sales Tax Rates: http://dor.mo.gov/business/sales/rates

- Internet Sales Tax: http://www.nolo.com/legal-encyclopedia/missouri-internet-sales-tax.html

- Missouri Tax Nexus: http://blog.taxjar.com/missouri-sales-tax-nexus/