The steps outlined below only cover how to get your business established as a legitimate business in "good standing" as defined by the state of Missouri. Much of the registration process is now done online through a computer. Please note this does NOT include the steps necessary for hiring employees (click here for information on hiring employees).

Process for Registering a New Business

[toggle_box]

[toggle_item title="1. Check your business name availability"]

Check to see if your preferred business name is available; click on the link below.

[button color="#ffffff" background="#1090c7" size="small" src="https://bsd.sos.mo.gov/BusinessEntity/BESearch.aspx" target="_blank"]CHECK BUSINESS NAME AVAILABILITY[/button]

![]() If your preferred business name is already in use, you will be required to select a different name. If you file a LLC then you must have "LLC", "L.L.C." or ", LLC" in your business name.

If your preferred business name is already in use, you will be required to select a different name. If you file a LLC then you must have "LLC", "L.L.C." or ", LLC" in your business name.

You are not required to register a name if you are a sole proprietorship or general partnership doing business under your legal name. However, if you want to go by a name other than your legal name, you need to register either a Fictitious Name (sometimes referred to Doing Business As) or a corporation. Sometimes corporations will have a legal name and also file for a fictitious name. For example, TOOTSIES & TWEETSIES, LLC is a legal business name which also has a fictitious name Beards and Bonnets for their branded Amish-style furniture and foods.

Name registrations are territorial. If you want to protect your name and make certain only you have legal rights for its use then consider filing for a trademark with the U.S. Patent and Trademark Office. You are not required to file for a trademark but it may be something you want for branding and to prevent marketplace confusion. Keep in mind that a U.S. trademark only provides legal rights inside the United States. If you want international legal protection of your name, then you must file separately in each county; there is no such thing as a global or universal trademark. However, there are treaties that can provide benefit to trademark filers but the first step is to file in your home (domestic) country.

[/toggle_item]

[toggle_item title="2. Select your business entity type"]

Select your business structure; review Missouri legal entities by clicking on the link below.

[button color="#ffffff" background="#1090c7" size="small" src="https://www.sos.mo.gov/business/corporations/startBusiness" target="_blank"]REVIEW MISSOURI LEGAL ENTITIES[/button]

![]() It is highly advisable that you talk with an attorney and an accountant in regard to the different business entity types and their legal and tax implications. You can also read about some of the bigger differences in our MissouriBusiness.net articles.

It is highly advisable that you talk with an attorney and an accountant in regard to the different business entity types and their legal and tax implications. You can also read about some of the bigger differences in our MissouriBusiness.net articles.

Please note SBTDC staff cannot provide official legal or tax advise nor can we endorse any private business.

- Missouri Lawyer Directory: http://www.mobar.org/lawyerdirectory.aspx

- Missouri Lawyer Search: http://www.mobar.org/lawyersearch.aspx

- Directory of Federal Tax Return Preparers: http://irs.treasury.gov/rpo/rpo.jsf

- Missouri Society of Accountants: http://www.missouri-accountants.com

- Missouri Society of Certified Public Accountants: http://www.mocpa.org

- MissouriBusiness.net article - Legal Formation: http://missouribusiness.net/article/doing-business-in-missouri-legal-formation/

- MissouriBusiness.net article - Legal Structure Comparison: http://missouribusiness.net/article/legal-structures/

[/toggle_item]

[toggle_item title="3. Register with the Missouri Secretary of State's business portal"]

Register with the Missouri Secretary of State's business portal; click on the link below.

[button color="#ffffff" background="#1090c7" size="small" src="https://bsd.sos.mo.gov/loginwelcome.aspx?lobID=1" target="_blank"]REGISTER WITH THE SECRETARY OF STATE[/button]

![]() You are not required to register online (you can still submit an old-fashion paper copy via snail mail) but I highly recommend it as the filing fee is reduced to $50.00. I recorded myself registering a business so you can see in advance what to expect during the online registration process. The resolution is poor but you will get the general idea of how this works.

You are not required to register online (you can still submit an old-fashion paper copy via snail mail) but I highly recommend it as the filing fee is reduced to $50.00. I recorded myself registering a business so you can see in advance what to expect during the online registration process. The resolution is poor but you will get the general idea of how this works.

Checkout the filing guides at http://www.sos.mo.gov/business/outreach/stepbystepguides.

If you file a Limited Liability Company (LLC), it is advisable to use the language:

The transaction of any lawful business for which a limited liability company may be organized under the Missouri Limited Liability Company Act, Chapter 347 RSMo.

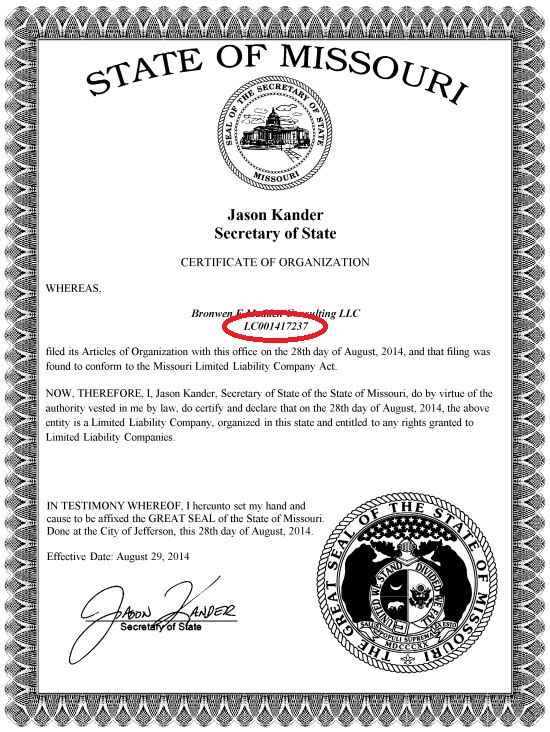

You will receive a certificate like the one pictured below. Print a copy for your records and note your business registration number (circled below).

[/toggle_item]

[toggle_item title="4. Get your federal tax ID number"]

Register your Federal Employer Identification Number (FEIN) with the Internal Revenue Service (IRS); click on the link below.

[button color="#ffffff" background="#1090c7" size="small" src="https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Apply-for-an-Employer-Identification-Number-(EIN)-Online" target="_blank"]REGISTER WITH THE IRS[/button]

![]() You will need your business entity number that you received from the Secretary of State's office from the previous step. If you need assistance, you can call the IRS at 1-800-829-4933.

You will need your business entity number that you received from the Secretary of State's office from the previous step. If you need assistance, you can call the IRS at 1-800-829-4933.

If you are filing as a LLC, most individuals (aka, Solopreneurs) will be considered a disregarded entity. For additional information, visit: http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/LLC-Filing-as-a-Corporation-or-Partnership

- Disregarded Entity – for individuals (owner’s tax return)

- Partnership – two or more people

- Corporation – requires that you file IRS Form 8832 (http://www.irs.gov/pub/irs-pdf/f8832.pdf) to be treated like a corporation

Save and print a copy of your FEIN number. You will need both your Articles of Organization certificate and your IRS letter noting your FEIN number to open a business checking account. Many banks will offer free business checking and if you want to cash a check made out to your business, this will be necessary. However, services like PayPal, Square, and Stripe have made it possible for businesses to have merchant services without a business checking account so entrepreneurs do have more options.

[/toggle_item]

[toggle_item title="5. Get your state tax ID number"]

(1.) Register your state tax ID number with the Missouri Department of Revenue and (2.) complete your Missouri Tax Registration Application form.

If you make retail sales then you need a Missouri Retail Sales License (Form 2643). A bond is also required and it is based on your projected monthly gross sales at the time of application. If you are a wholesaler or buying at wholesale prices, then you will need a Sales and Use Tax Exemption Certificate (Form 149) to provide to your supplier showing the sale is exempt from sales tax .

[button color="#ffffff" background="#1090c7" size="small" src="https://dors.mo.gov/tax/coreg/index.jsp" target="_blank"]REGISTER WITH THE DOR[/button]

- Missouri Department of Revenue (DOR) and the Department of Labor and Industrial Relations, Division of Employment Security Online Business Registration: https://dors.mo.gov/tax/coreg/index.jsp

- Missouri Department of Revenue Form 2643: http://dor.mo.gov/forms/2643.pdf

- Missouri Department of Revenue Form 149: http://dor.mo.gov/forms/149.pdf

- Missouri Department of Revenue Small Business webpage: http://dor.mo.gov/business/smallbusiness

- Video: Do I need to register as a business (with the DOR) in Missouri?

Contact DOR if you have any questions.

Missouri Department of Revenue

Division of Taxation & Collection

P.O. Box 3300

Jefferson City, MO 65105

Fax: (573) 522-1722

Telephone: (573) 751-5860 Option 5

Web Site: http://dor.mo.gov/

E-mail: BusinessTaxRegister@dor.mo.gov

![]() You will need your FEIN number for this step. It may take about two weeks before you will be issued your state tax ID number as you will have to snail mail a money order for your bond. Keep this in mind if you need to buy inventory or supplies for your business at the wholesale rate; vendors will request your state tax ID number before doing business with you.

You will need your FEIN number for this step. It may take about two weeks before you will be issued your state tax ID number as you will have to snail mail a money order for your bond. Keep this in mind if you need to buy inventory or supplies for your business at the wholesale rate; vendors will request your state tax ID number before doing business with you.

Here is a brief video that will help you with this step.

Bond Information

Cash bonds are generally the easiest type of bond but here is an overview of your bond options. See the video below about tax bonds and use the Sales/Use Tax Bond Calculator: http://dort.mo.gov/tax/calculators/bond to help you know the amount you should send to DOR.

- Cash Bond

- Form 332 http://dor.mo.gov/forms/332.pdf

- This would be a cashier’s check (from a bank) or a money order (from a bank or the U.S. Post Office)

- Surety Bond

- Form 331 http://dor.mo.gov/forms/331.pdf

- This is issued by an insurance company

- Irrevocable Letterer of Credit

- Form 2879 http://dor.mo.gov/forms/2879.pdf

- This is issued by a financial institution

- Certificate of Deposit

- Form 4172 http://dor.mo.gov/forms/4172.pdf

- This is issued by a federally chartered financial institution (a national bank)

[/toggle_item]

[toggle_item title="6. Register with your County and City business offices"]

You will need to register with the County where your business is located to get a merchant's license (this is only applicable if you are selling products). Their office is usually located at your County Courthouse. If you are within the city-limits, then you will also need to register with your city business office usually located at City Hall. If you have a food service establishment, you need to contact your County Health Department for an inspection.

Click on the map markers below to find the contact information for your City and County offices. If an application is required, click on the URL for an edit-able PDF. Most cities and counties will have an annual business license fee and require a copy of your state tax ID number.

If the map below fails to load properly, click this link.

[/toggle_item]

[toggle_item title="7. Obtain other applicable business licenses"]

Review the list of licensed professions through the Missouri Division of Professional Registration and other links with industry specific information.

- Professions: http://pr.mo.gov/professions.asp

- Licensing Forms: http://difp.mo.gov/licensing/

- Register your Business (see the section Specific Permits/Licenses and State, Federal and Local Agencies): http://business.mo.gov/register/index.html

- MissouriBusiness.net article - License and Registration Checklist: http://missouribusiness.net/article/licenses-registration-checklist/

- MissouriBusiness.net article - Industry Guides: http://missouribusiness.net/category/industry-profile/

![]() Depending on your profession or the type of business you want to operate, additional licenses may be required. It is your responsibility to be compliant and follow all federal, state and/or municipal regulations. For example, a gunsmith needs a federal license from ATF (see: https://www.atf.gov/firearms/apply-license); a pest control business needs a state license from MDA (see: http://agriculture.mo.gov/plants/pesticides/licensing.php).

Depending on your profession or the type of business you want to operate, additional licenses may be required. It is your responsibility to be compliant and follow all federal, state and/or municipal regulations. For example, a gunsmith needs a federal license from ATF (see: https://www.atf.gov/firearms/apply-license); a pest control business needs a state license from MDA (see: http://agriculture.mo.gov/plants/pesticides/licensing.php).

[/toggle_item]

[/toggle_box]

Helpful but not mandatory

[toggle_box]

[toggle_item title="Read the MissouriBusiness.net Articles"]

- Guide to Writing a Business Plan: http://missouribusiness.net/article/guide-to-writing-business-plan

- Evaluating Your Business Idea: http://missouribusiness.net/wp-content/uploads/evaluating-business.pdf

- Starting a New Business in Missouri: http://missouribusiness.net/article/starting-new-business-missouri

- How to Start and Manage a Home-based Business: http://missouribusiness.net/article/home-based-business

- Start-up Articles: http://missouribusiness.net/library/startup/

[button color="#ffffff" background="#1090c7" size="small" src="https://missouribusiness.net/library/" target="_blank"]GO TO MISSOURIBUSINESS.NET ARTICLES[/button]

[/toggle_item]

[toggle_item title="Identify your NAICS code"]

You can use your NAICS code to gather market research on your industry and to identify benchmarks for the industry as a whole in your region. This can be very helpful for new businesses since they do not have historic numbers of their own. There are a number of tools the SBTDC has available, including BizMiner, ProfitCents, ESRI, and LivePlan, that offer industry information based on your NAICS code that will assist with your financial projections.

[button color="#ffffff" background="#1090c7" size="small" src="https://www.census.gov/eos/www/naics/" target="_blank"]IDENTIFY YOUR NAICS CODE[/button]

[/toggle_item]

[toggle_item title="Write a Business Plan"]

Business Plans serve two primary purposes. The first is to help you focus your idea and create a road map for success. It is inevitable that you will have to make adjustments in your business and proper planning will allow for you to make informed decisions more efficiently. The second reason for a business plan is funding. Any investor (equity finance) or lender (debt finance) is going to want to know how you plan to use the money and how you will grow and provide a return. Business plans MUST show a positive cash-flow and for a traditional business loan, you need to have a 1.2% or higher DSCR.

We use LivePlan for business planning; SBTDC clients are set up with a free account.

[button color="#ffffff" background="#1090c7" size="small" src="https://liveplan.com" target="_blank"]WRITE A BUSINESS PLAN[/button]

[/toggle_item]

[toggle_item title="Find a Mentor"]

Work with the U.S. Small Business Administration (SBA) Resource Partners to help guide and mentor you in your business. SBA resource partners are business professionals and never charge a fee for consulting services.

[button color="#ffffff" background="#1090c7" size="small" src="https://www.sba.gov/tools/local-assistance" target="_blank"]FIND A MENTOR[/button]

[/toggle_item]

[/toggle_box]